Choosing between domestic vs. overseas label printing no longer requires sacrificing speed for cost. This guide reveals how 2026 supply chain innovations like DDP air freight and TCO modeling allow CPG brands to achieve local lead times with global manufacturing savings.

In 2026, the choice between domestic vs. overseas label printing depends on Total Cost of Ownership (TCO). While domestic offers 48-hour agility, overseas air-DDP models now provide 7-12 day delivery at 30-50% lower unit costs, making global sourcing viable for high-frequency, agile brands.

But the unit price is only 30% of the story. Keep reading to discover the hidden TCO formula and why the “distance gap” is officially dead in 2026.

Understanding Total Cost of Ownership in Label Procurement

When you compare quotes, it is tempting to look only at the “unit price” at the bottom of the page. You see $0.12 per label from a US supplier and $0.08 from an overseas factory, and the choice seems obvious.

However, looking at the purchase price alone is a dangerous simplification. In the 2026 market, your financial director cares about Total Cost of Ownership (TCO), not just the invoice amount.

“The historical focus on unit cost in packaging is giving way to a more sophisticated view of Total Value of Ownership (TVO).” — As David Feber, Senior Partner at McKinsey, points out.

He argues that companies are now prioritizing agility because the cost of a stock-out or obsolete inventory often dwarfs any savings from a lower-priced, slower-moving component.

To make a truly informed decision, you need to use the TCO formula:

$$TCO = P + L + I + C + R$$

- P (Purchase Price): The base cost of the labels.

- L (Logistics): Freight and DDP duties.

- I (Inventory): The cost of holding stock and tied-up capital.

- C (Compliance): Testing and certification costs.

- R (Risk): The cost of delays or quality failures.

Data from 2026 shows that while overseas unit prices can be 35% to 50% lower, the purchase price only represents about 30% of your actual TCO. The other 70% is hidden in logistics and risk.

This is where the “Air + DDP” model changes the math. By choosing high-frequency air shipping over bulk sea freight, you drastically reduce the “I” (Inventory) and “R” (Risk) factors in the equation.

| Cost Factor | Domestic Supplier | Overseas (Sea Freight) | Overseas (Air DDP) |

|---|---|---|---|

| Unit Price | High ($0.15) | Lowest ($0.08) | Low ($0.09) |

| Inventory Carrying Cost | Low (JIT) | High (6 months stock) | Low (Monthly) |

| Capital Cost (WACC) | 2% | 15% | 4% |

| Total Strategic Cost | Moderate | High | Optimal |

Why does this matter for your bottom line? It comes down to Weighted Average Cost of Capital (WACC).

If you tie up $50,000 in label inventory for six months to save on sea freight, you aren’t just paying for the labels. You are paying for the “locked” cash that could have been used for marketing or R&D.

When you switch to a “7-day delivery” overseas model, you optimize your cash flow and give your brand the freedom to update designs without throwing away thousands of dollars in old stock.

Logistics and the 7-Day Delivery Myth

In 2026, the term “overseas” no longer implies a 45-day wait on a slow-moving boat. If you are still associating international sourcing with long delays, you are missing out on a massive tactical advantage. For mid-sized brands, premium logistics has become a strategic weapon.

Kamala Raman, VP Analyst at Gartner, hits the nail on the head: “The ‘just-in-case’ model is evolving into ‘anti-fragility.'” The ability to source globally while maintaining localized lead times through premium logistics is a strategic competitive advantage.

But how do we actually bridge that thousands-of-mile gap? The answer lies in the Air + DDP (Delivered Duty Paid) model. This isn’t just shipping; it’s a transparent, high-speed pipeline designed to match the agility of local shops. Let’s break down the timeline you can expect:

- Factory Production: 3 to 5 days

- Air Freight: 3 to 4 days

- Last-Mile Delivery (US): 1 to 2 days

- Total Turnaround: 7 to 12 days

When you compare this to many US-based printers—who are often bogged down by massive backlogs and 10 to 14-day lead times—the “local speed advantage” starts to look like a myth.

Ready to Lower Your Label TCO by 30%?

Our “Machine-Ready” labels ensure 100% adaptation to your production line while cutting costs through extreme inventory velocity.

To truly understand why speed matters, you need to look at the Cost of Stock-out Risk (CSR). Use this simple formula:

CSR = Daily Revenue × Delay Days × Profit Margin

Consider the story of a fast-growing supplement brand I worked with. They followed the common advice to use sea freight to get the lowest possible unit price, ordering a 12-month supply of labels.

While their labels were somewhere in the middle of the ocean, the FDA updated a specific ingredient labeling requirement. Because their entire inventory was locked on a slow boat, they couldn’t pivot.

They had to choose between paying an army of workers to manually apply “correction stickers” or destroying $18,000 worth of product.

They chose the latter, and that single event wiped out three years of procurement savings.

By switching to our “Air + DDP” model, they moved to a rolling monthly order system. Yes, they paid a small premium for air freight, but they gained the “zero-second” reaction power needed to handle regulatory changes without breaking a sweat.

In 2026, paying for speed is simply buying insurance for your supply chain, ensuring you have the agility to implement shelf-ready aesthetics that keep your brand ahead of the competition.

Ensuring Quality and Precision with Data

One of the biggest fears in the Domestic vs. Overseas Label Printing debate is the “black box” of quality.

You might worry that a factory thousands of miles away won’t match your brand’s specific Rose Gold or that the adhesive will fail in a cold-chain environment. In the past, you relied on a physical sample and a prayer. In 2026, we replace that prayer with raw data.

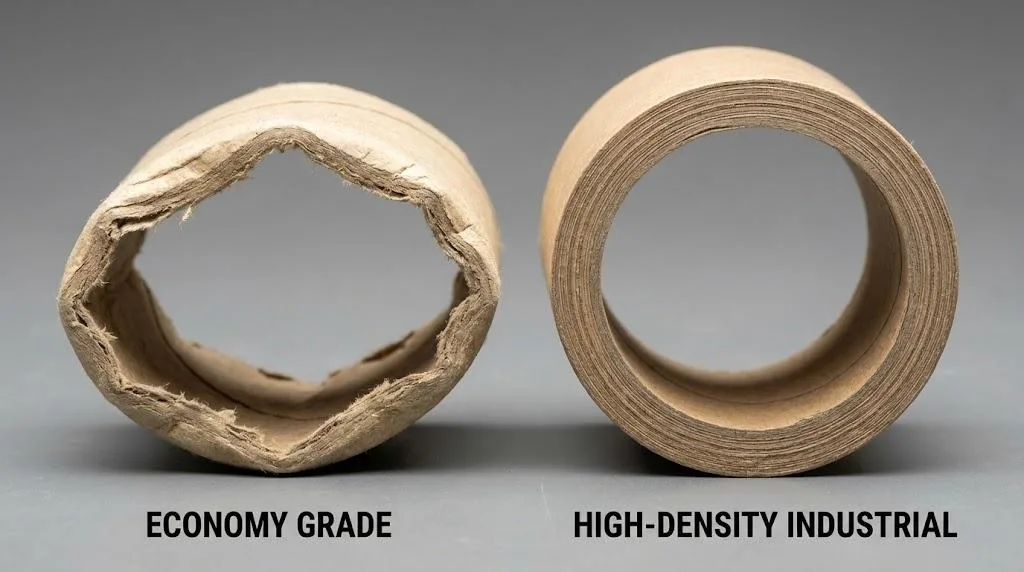

The industry’s “dirty secret” is that many low-cost overseas factories swap out brand-name substrates for generic alternatives to shave off a few cents. While the paper weight might be the same, the whiteness and absorption levels differ, leading to a visible color shift.

I once saw a high-end skincare brand suffer a “color disaster” because they relied on a simple digital proof. The labels arrived with a greenish tint because the supplier didn’t understand the chemistry of the coating.

To avoid this, you must demand data, not just promises. Professional factories today use X-Rite spectrophotometers to measure color accuracy. You should insist on a Delta E (ΔE) value of less than 1.5.

This isn’t just a number; it is a mathematical guarantee that the color difference is invisible to the human eye. Furthermore, ensuring your supplier follows the ISO 12647-2 standard for offset or digital printing is non-negotiable for brand consistency.

How do you ensure every batch is identical? You stop “eyeballing” samples and start requiring a spectral measurement report with every shipment. If a factory can’t provide a report showing that their ΔE is consistently under 1.5, they aren’t equipped to handle a professional CPG brand.

By shifting your focus from “how it looks” to “what the data says,” you eliminate the risk of “batch 2” quality drops and build a relationship based on verifiable precision.

By 2026, “being green” has shifted from a marketing buzzword to a strict legal requirement. If you are shipping products into states like California, you already know that environmental audits are becoming as rigorous as financial ones. The “Green Premium” is no longer just about choosing recycled paper; it is about proving it.

One of the biggest pitfalls for overseas sourcing used to be the “compliance black box.” However, top-tier global partners have adapted. To stay ahead of the curve, your labels must meet three core pillars of 2026 sustainability:

- PCR Content: Many states now mandate that label liners or face stocks contain at least 30% Post-Consumer Recycled (PCR) material.

- FSC Chain-of-Custody: It is not enough for a factory to say they use “good wood.” You need a verifiable FSC certification that tracks the fiber from the forest to your warehouse.

- Chemical Compliance: 2026 regulations have tightened around solvent-based adhesives. If your labels use non-compliant inks or glues, they could be seized by customs or trigger heavy “plastic taxes” at the border.

You might be worried about Section 301 tariffs, which can hover between 7.5% and 25% for Chinese-printed goods. This is where the DDP (Delivered Duty Paid) model becomes your best friend.

In a DDP agreement, the total figures generated by a landed cost calculator include all duties and taxes, providing you with absolute price certainty.

You don’t have to worry about unexpected bills from a customs broker. Choosing an overseas partner who understands these 2026 mandates isn’t just about ethics; it’s about protecting your brand from “compliance-related stock-outs.”

When your supplier provides a certified sustainability report alongside your shipment, you aren’t just buying labels—you’re buying a clean audit trail.

Implementing a Hybrid Agile Strategy

In the face of 2026’s unpredictable trade environment and tightening regulations, the most successful procurement managers have abandoned the “all-or-nothing” approach. They no longer choose between Domestic vs. Overseas Label Printing; they use a Hybrid “1+1” Strategy.

This model treats your local printer as an “emergency reserve” and your overseas partner as your “strategic powerhouse.” Here is how you can implement it:

- The Local Pillar (10-20% of Volume): Keep your local supplier for ultra-short test runs, 48-hour emergency patches, or products that must meet the strict new 2026 “Product of USA” voluntary labeling standards.

- The Global Pillar (80-90% of Volume): Use an overseas expert like Zhongda for your core SKUs. By utilizing our Air + DDP model, you get the cost-efficiency of global manufacturing with a delivery speed that rivals domestic lead times.

Before you sign your next contract, it is critical to master label supplier vetting standards and ask these five ‘soul-searching’ questions to your potential overseas supplier:

- Can you provide a spectral measurement report proving a Delta E < 1.5 for every batch?

- Do you offer a guaranteed 7-to-12-day DDP air freight window to bypass port congestion?

- Are your materials compliant with the 2026 EU PPWR and US PCR recycled content mandates?

- Do you use Digital Twins or AI-driven analytics to share real-time production visibility?

- What is your SOP for “Risk Mitigation” if a regulatory change happens while goods are in transit?

By moving to this hybrid model, you aren’t just buying labels; you are building a distributed disaster recovery system for your brand.

Conclusion: Procurement is a Balance of Risk and Efficiency

As we navigate through 2026, the definition of a “great deal” has evolved. It’s no longer about finding the absolute lowest unit price on a spreadsheet, especially when a professional label printing cost analysis reveals the hidden financial risks of production downtime.

It’s about balancing Domestic vs. Overseas Label Printing to create a supply chain that is fast, compliant, and fiscally lean.

Strategic procurement managers are now shifting their focus toward Inventory Velocity and Total Value of Ownership. They understand that the “distance gap” has been bridged by technology, data-driven quality control, and ultra-fast air logistics. Choosing the right partner means choosing a supplier who manages your risks as carefully as they manage their ink levels.

Don’t let your brand be held hostage by slow-moving sea freight or overpriced local monopolies. It’s time to optimize your procurement for the modern era.

Ready to modernize your label supply chain? schedule a complimentary Supply Chain Stress Test with our team of experts. Let us help you turn your labels from a cost center into a competitive advantage.